Introduction

Hey there, fellow readers! Welcome to Rintiksedu.id. Today, we are going to delve into the topic of “Cara Blokir ATM BRI” and discover some useful information about it. As someone with hands-on experience in the matter, I am excited to share my knowledge with you all. To give you a glimpse, here’s an eye-catching featured image related to the topic:

Section 1: Understanding Cara Blokir ATM BRI

Exploring the Reasons

Before diving into the details, let’s first understand the reasons why one may need to block their BRI ATM. This section will shed light on various scenarios where blocking an ATM card becomes necessary. From lost cards to suspicious activities, we’ll cover it all.

Methods to Block Your ATM Card

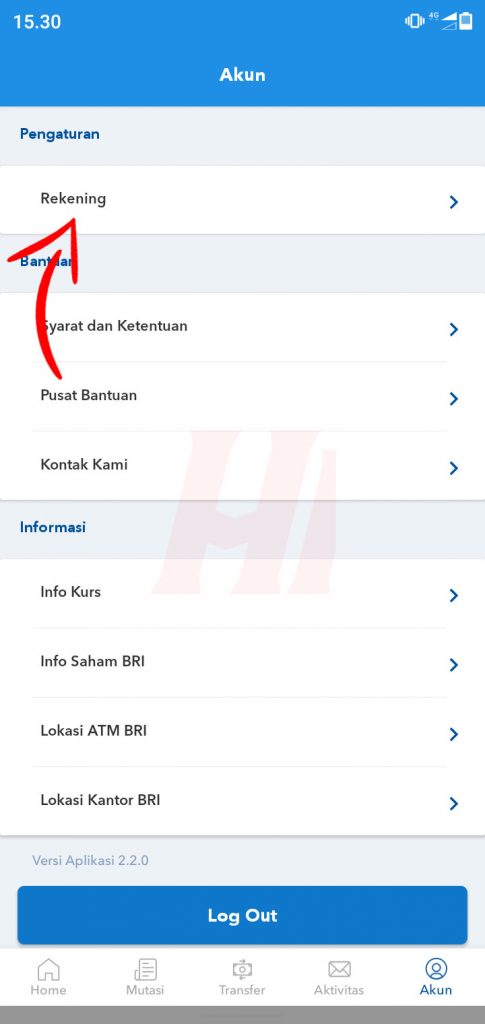

In this part, we will walk you through several methods to block your ATM card with BRI. We’ll cover both online and offline options, ensuring that you are well-equipped with the necessary knowledge to take quick action and protect your account.

Section 2: Frequently Asked Questions

Q: What should I do if my BRI ATM card goes missing?

A: If you can’t find your BRI ATM card, immediately contact the bank’s hotline at [insert phone number] and request them to block your card to prevent any unauthorized transactions.

Q: Can I temporarily block my ATM card?

A: Yes, BRI offers the option to temporarily block your ATM card through their mobile banking app or internet banking portal. Simply follow the instructions provided to activate this feature.

Q: How long does it take for the ATM card to be blocked?

A: When you report a lost or stolen ATM card to BRI, they swiftly take action to block it. Generally, it takes a few minutes for the card to be blocked, ensuring the safety of your funds.

Q: Are there any fees for blocking the ATM card?

A: No, BRI does not charge any fees for blocking your ATM card. It is a precautionary measure taken by the bank to protect your account from any potential misuse.

Q: Can I unblock my card after it has been blocked?

A: Yes, if you happen to find your previously blocked ATM card, you can visit the nearest BRI branch and request them to unblock it. They will guide you through the necessary steps to reactivate your card.

Q: Can I block my ATM card while abroad?

A: Absolutely! BRI provides international helplines specifically for situations where you need to block your ATM card while abroad. These helplines are available 24/7 and can be contacted for immediate assistance.

Q: How can I prevent my ATM card from being blocked?

A: To prevent your ATM card from getting blocked, make sure to keep it in a safe place at all times. Also, avoid sharing your card details with anyone and regularly monitor your account for any suspicious activities.

Q: What is the maximum limit to block an ATM card?

A: There is no maximum limit to block your ATM card with BRI. Whether you misplaced it once or for the fifth time, you have the flexibility to quickly take action and block it for your peace of mind.

Q: Can I block my ATM card online?

A: Yes, BRI offers the convenience of blocking your ATM card online through their official website. Simply log in to your account and proceed with the necessary steps to block your card.

Q: Is there an emergency hotline to block my ATM card?

A: Yes, BRI provides an emergency hotline that can be contacted immediately to block your ATM card. Keep this number saved in your phone so that you can act promptly in case of emergencies.

Conclusion

So there you have it, folks! We have covered various aspects of “Cara Blokir ATM BRI” in this article. From understanding the reasons behind blocking your ATM card to learning the methods involved, we hope you now feel more prepared to tackle any situation that may arise. Remember, quick action is crucial when it comes to the security of your account. Stay safe and take care!